Financial & Estate Planning

March 26, 2024

While it can be difficult to think about, financial planning after a brain tumor diagnosis is important. Having things in place, like a Will and Power of Attorney, could decrease your stress. It might also help you spend more quality time with your family and friends.

When planning your finances, you may start to consider some legal decisions. For example, who has control of your finances now and in the future?

- Evaluate the impact of the brain tumor diagnosis on your ability to work and earn income. Determine if you or the patient will need to take time off from work for treatment, recovery, or caregiving responsibilities.

- Explore options for disability insurance, paid leave, or other benefits available through your employer or government programs such as Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI).

- Research financial assistance programs specifically designed to help individuals and families facing medical crises like a brain tumor diagnosis. These may include government assistance programs, nonprofit organizations, and local community resources.

- Seek guidance from a financial counselor or social worker who can help you navigate available resources and apply for financial assistance programs.

- A financial advisor can help you with financial planning. This can include decisions on mortgages, investments and savings but an independent financial advisor will charge a fee for their services.

- Develop a realistic budget that accounts for both essential expenses (e.g., housing, utilities, food, transportation, healthcare) and discretionary spending. Prioritize expenses based on importance and available resources.

- Look for opportunities to reduce costs or increase income where possible. This may include negotiating bills, refinancing loans, finding alternative sources of income, or selling unnecessary assets.

- Review your health insurance coverage to understand what is covered and what out-of-pocket expenses you may incur related to the brain tumor diagnosis and treatment. Consider supplemental insurance options if necessary.

- Keep track of medical bills, prescription costs, co-pays, and other healthcare-related expenses. Explore options for financial assistance or patient support programs offered by hospitals or pharmaceutical companies.

- Consider setting up a Health Savings Account (HSA) or Flexible Spending Account (FSA) to save pre-tax dollars for medical expenses.

- Also consider if your loved one has short term or long term disability benefits through their insurance.

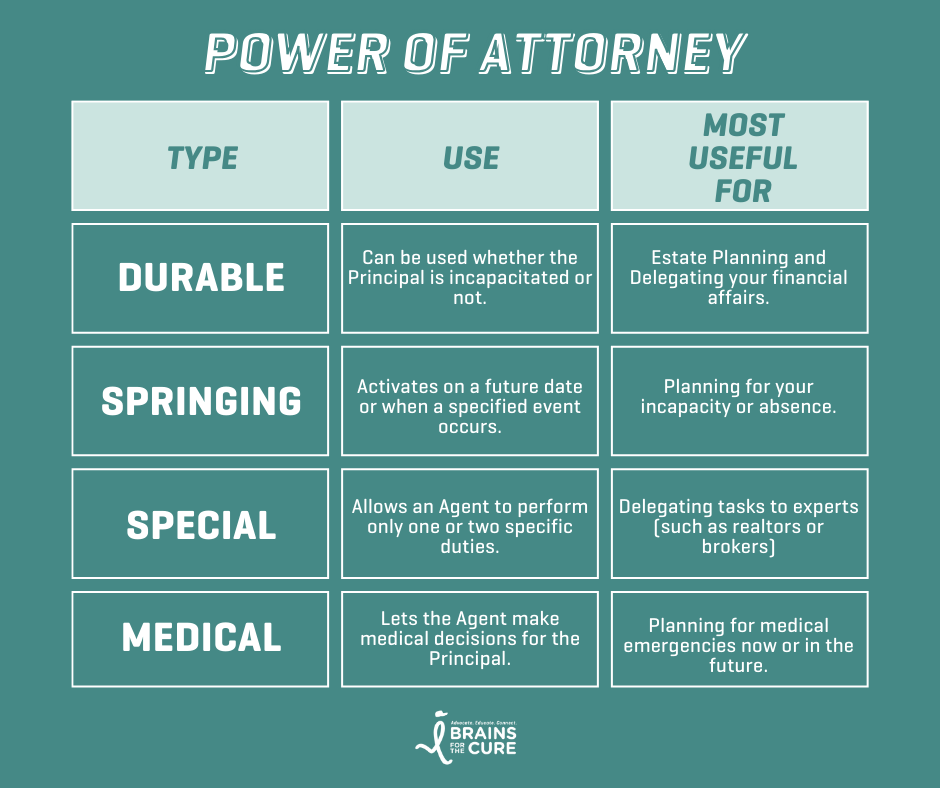

Choosing the right type of Power of Attorney (POA) legal form can be a big decision. There are many different options available to an individual (known legally as the principal) seeking to transfer their authority to an agent (sometimes known as the Attorney-in-Fact) for decision-making purposes.

While the person you grant Power of Attorney to doesn’t need to be a lawyer, they should be someone you trust to make the necessary choices for you effectively. You should also grant them the correct authority depending on the functions you want them to perform.

A Will is a legal document that enables you to instruct who gets your property, possessions, and money after your death. This is known as your estate. For many people, having a valid Will is reassuring. It means you’ve made provision for the people and causes you care about the most. This is particularly important for those who are not married or in a registered civil partnership, as well as those who have children under 18.

Writing a Will makes sure you get to decide what happens with your assets (such as property, valuables, and savings) after death.

It allows you to choose who you want them to go to (the beneficiaries, e.g., family, friends and charities). You can also decide how they will be allocated. You can choose the person(s) you want to allocate. If there is no Will, there are certain rules that dictate how your money, property, or possessions should be allocated. This may not be the way you would have wished. As a result, the people or causes that are important to you might not receive anything.

The law doesn’t automatically recognize unmarried partners or those not in civil partnerships. Without a Will, you will not have the same rights as – no matter how long you’ve lived together. If you want to leave something to a partner, to whom you’re not married or in a civil partnership, or to a close friend, you generally need to include instructions to that effect in your Will.

What else goes in a Will?

Writing a Will isn’t just about deciding who is going to inherit your estate; it’s also an opportunity to leave instructions about a funeral, burial, or cremation. It may not be easy to think about this subject, but leaving clear instructions in a Will means your relatives and friends won’t need to make that decision. Don’t forget to make sure someone knows where the Will is kept.

You may also want to consider donating your organs (including brain donation) or furthering research by leaving instructions about gathering tumor samples that will be used to help researchers understand brain tumor development.

Consult with an attorney specializing in estate planning and elder law to ensure your wishes are documented and legally binding.